Let's apply for your R&D research bonus (Forschungsprämie) together

Let's apply for your R&D research bonus

(Forschungsprämie) together

R&D research bonus (Forschungsprämie)

In Austria, companies can have 14% of their total research and development costs subsidized. For expenses already incurred in the context of industrial research and experimental development, they can retroactively claim the research bonus from the tax office in accordance with § 108c of the Austrian Income Tax Act (EStG).

The research bonus is available by law to any innovative company subject to taxation in Austria. This is a two-stage procedure. In the event of a positive review by the FFG and recognition by the tax office, the research bonus is credited to the tax account (legal claim!). The research bonus is also due in the case of failed research and development. Even in the case of a negative annual result (loss), it is credited to the levy account and paid out upon request.

Overview of the research premium

Legal entitlement for the following activities:

Basic research, applied research (industrial research), and experimental development.

pilot projects & prototypes

failed R&D projects

projects already funded elsewhere (directly funded projects are also eligible for the research premium!)

Contract research

Support throughout the application process:

Identification of your eligible R&D projects.

Joint preparation of technical documentation

Review & finalization of the application documents

- Support in determining the basis of assessment

Three criteria for success with ITS Förderberatung:

Quality

Professional project management

Experienced technicians with relevant qualifications

Expert support in cost representation

Efficiency

Joint formulation of applications with your and our technicians (on-site & online)

Partnership

Common goals – success-oriented fee structure

We help you to get your research bonus (Forschungsprämie)

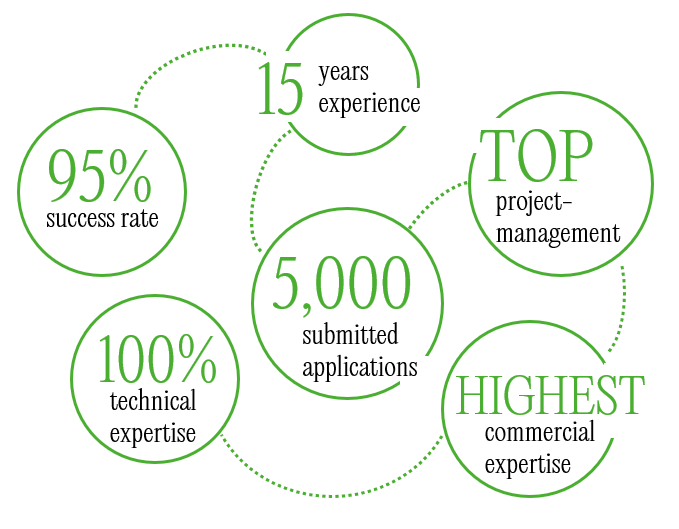

As funding experts for the research bonus, we are your reliable contact. Our team, consisting of highly qualified technicians and experienced project managers, will guide you through the entire application process and support you in successfully applying for R&D funding. Together we say: ITS possible

Your competitive advantage is us:

ITS Förderberatung.

Frequently asked questions about the R&D research bonus

The term “research” is defined according to § 108c EStG and the ordinance issued for this purpose. In addition, the Frascati Manual (2015), the OECD Handbook on Research Statistics is also used to define the term. Included are:

New developments such as prototypes or pilot plants

New and further developments of products

New and further developments of processes

Experimental development

Also failed research and development

The research activity can be carried out in-house or as a contract to another company. Depending on this, the eligibility criteria vary:

In-house research: conducted in a domestic company with its own staff. The research bonus (Forschungsprämie) amounts to 14% of the expenses for research and experimental development.

Contract research: a client awards a research and development contract to a domestic or EU/EEA-based third party (e.g. a company or a university).

The client can apply for 14% of the contract volume as a research bonus, max. 1,000,000 euros, for contract research.

Be careful, because contract research within a group of companies or a tax group of companies in the sense of § 9 KStG is not eligible for funding.

We will be happy to inform you personally about the other framework conditions for the funding of contract research.

The research bonus can be applied for retroactively by:

- any taxable enterprise in Austria that meets the legal requirements for the research bonus

- which carries out research and development services in Austria or awards research contracts to third parties domiciled in the EEA,

- irrespective of the company’s industry.

The process for claiming the research bonus for in-house research and experimental development is as follows:

To claim the research bonus, a company must submit an application to the relevant tax office after the end of a business year. The application is usually submitted together with the tax return for an expired business year.

In addition, an expert opinion from the Austrian Research Promotion Agency (FFG) must be requested. The application consists of a description of a maximum of 20 projects or focus areas. Each of these projects/focus areas may be described in a maximum of 3000 characters without graphics or images. The expert opinion of the FFG decides whether the in-house research activities of companies for which a research bonus is applied for constitute favored research and experimental development within the meaning of the Income Tax Act and the ordinance issued in this regard.

The tax office determines whether the submitted research and development expenses (the assessment basis) have been calculated in accordance with the legal requirements. The FFG assesses whether the substantive requirements for claiming a research bonus have been met.

The FFG does not assess whether the assessment basis for the research bonus has been calculated correctly.

The FFG does not make a decision on the award of the research bonus. This decision is made by the competent tax office. As a rule, the tax office follows the FFG’s assessment.

The FFG prepares the expert opinion for the company free of charge.

The request for an expert opinion is made via “FinanzOnline”, the electronic access to the tax administration and is subject to strictly regulated formal requirements. The FFG’s expert opinion is then automatically transmitted via “FinanzOnline” to the tax office and to the applicant.

Annual expert opinion (FFG-Jahresgutachten)

In order to claim the research bonus, an annual expert opinion from the Austrian Research Promotion Agency (FFG) is normally required. (Exception: no expert opinion is required for contract research). In doing so, the FFG checks whether the substantive requirements are met in accordance with the provisions of the “Frascati” Manual. The correctness of the assessment basis is checked by the tax office.

The FFG expert opinion is not binding for the tax office. Even if the FFG expert opinion (which is based on a description of a maximum of 3000 characters per focal point) is negative, the tax office can still pay the research bonus to the company after further and more comprehensive documentation has been submitted.

Project appraisal

Instead of the annual appraisal, a project appraisal can also be requested from the FFG for a single project at a time.

Project appraisals serve as the basis for a research confirmation from the tax office that the requirements for in-house research have been met. It thus leads to increased legal certainty. An administrative fee of 1,000 euros is charged for each project report. It can be applied for the current year and for a maximum of three years into the future.

Optional: Confirmation by auditor

If you want to obtain legal certainty about the amount of the assessment basis or the way it was determined, you must also submit confirmation from an auditor to the tax office. Together with the annual report or the project report and on the basis of this confirmation, the tax office subsequently issues a notice of assessment on the amount of the bonus.